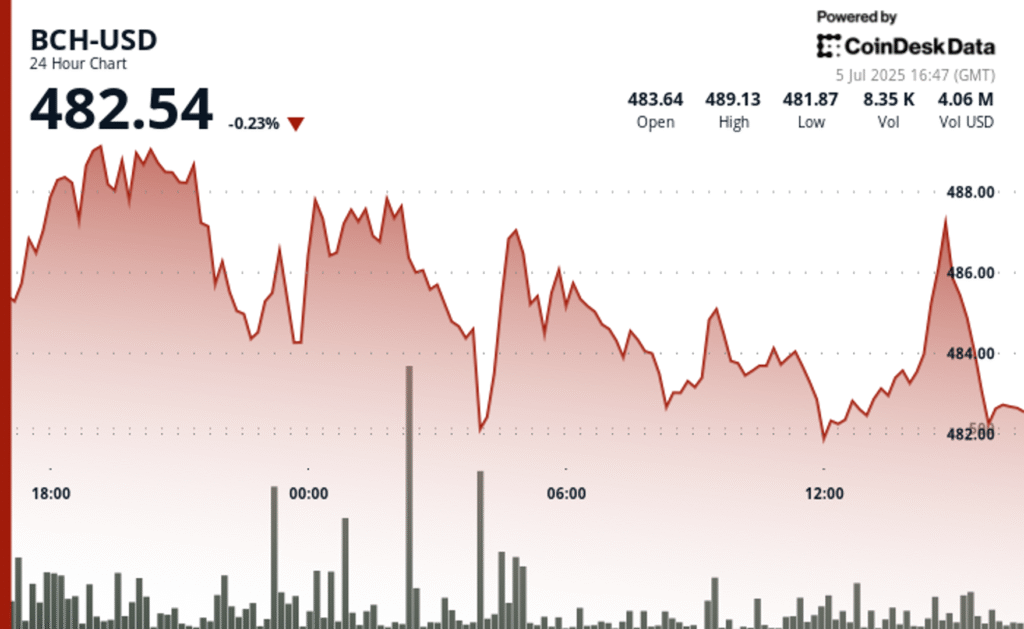

Bitcoin Cash (BCH) traded at $482.54 on July 5, down 0.23% over the past 24 hours, following a broader retreat from its recent multi-month high, according to CoinDesk Research’s technical analysis model. As for the broader crypto sector as gauged by the CoinDesk20 Index (CD20), it is up 0.27% during the same period.

On July 1, BCH reached $526.5 — its highest price in eight months — as market enthusiasm, whale accumulation, and speculative inflows helped propel the token more than 75% higher over the past three months.

The surge, briefly taking BCH above $528, coincided with a substantial increase in daily trading volume, which tripled to over 120,000 tokens exchanged within a 24-hour span. Much of the buying interest was attributed to capital rotation into mid-cap cryptocurrencies, as investors sought gains beyond the majors during a period of broader crypto market strength.

On-chain fundamentals, however, remain lackluster. Daily active BCH addresses have dropped to a six-year low, suggesting that the rally is being driven more by speculation than by increased network utility. Despite this disconnect, technical indicators point to further upside potential. In late June, a golden cross formation appeared on BCH’s hourly chart—where the 50-day moving average crossed above the 200-day MA—a historically bullish signal.

Adding to the speculative momentum, open interest in BCH derivatives rose 27.4% this past week to $578 million. Analysts are watching the $478 to $508 range closely, viewing it as a key support zone that could stabilize the current pullback.

On July 4, analytics firm IntoTheBlock reported a 122.45% increase in large whale transactions involving over $100,000 in BCH, totaling 957,440 tokens worth approximately $482 million. This sharp rise in high-value transfers echoed earlier activity spikes seen in February, May, and late June—all of which preceded major price movements.

A separate development on July 5 raised further intrigue, when a 10,000-BCH transaction worth roughly $5 million was flagged just prior to the historic movement of 80,000 dormant BTC — valued at over $8.5 billion. Experts suggest the BCH transfer may have served as a key test of wallet access before executing the massive Bitcoin transaction, which was the largest of its kind in over a decade.

Meanwhile, the Bitcoin Cash Foundation published its July 1 update highlighting the release of Knuth v0.68.0, which unifies the node’s codebase and lays the groundwork for future UTXO efficiency upgrades. While no major adoption headlines emerged this week, smaller community projects continue to explore BCH-based micropayments and NFTs. Roger Ver, a longtime proponent of Bitcoin Cash, remains publicly active in promoting BCH as a scalable alternative to bitcoin, though his recent advocacy has not been accompanied by any new institutional product launches.

Technical Analysis Highlights

- BCH traded within a $7.52 (1.57%) range between $481.83 and $489.35 from July 4 15:00 to July 5 14:00.

- Strong support was observed at $481.83 with elevated volume during the 04:00 hour on July 5.

- Resistance formed at $489.43, where repeated selling pressure capped gains.

- From 13:06 to 14:05 UTC on July 5, BCH gained $1.20 (0.25%), briefly breaking above $483.25 on rising volume.

- Support in the final minutes of the session formed between $483.35 and $483.45, with price peaking at $483.81 during the 14:03 candle.

isclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.