A key metric called perpetual funding rates is signaling bullishness for top altcoins as bitcoin (BTC) kicks off the traditionally weak third quarter quarter with flat price action.

Funding rates, charged by exchanges every eight hours, refer to the cost of holding bullish long or bearish short positions in the perpetual (perps) futures (with no expiry).

A positive funding rate indicates that perps are trading at a premium to the spot price, necessitating a payment from longs to shorts to maintain bullish bets. Therefore, positive rates are interpreted as representing bullish sentiment, while negative rates suggest otherwise.

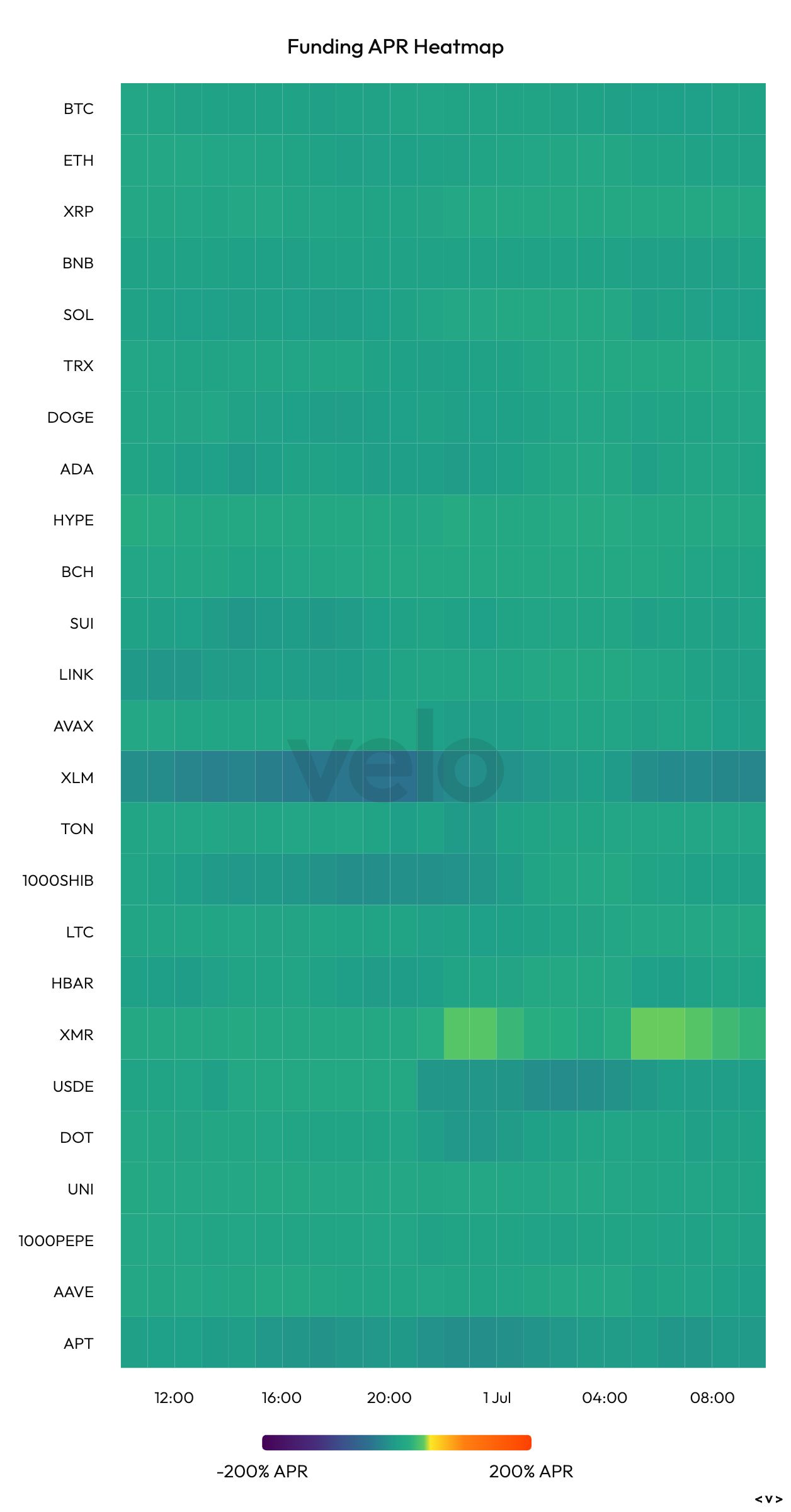

As of writing, perps tied to payments-focused token XRP (XRP), the world’s fourth-largest digital asset by market value, had an annualized funding rate of nearly 11%, the highest among the top 10 tokens, according to data source Velo. Funding rates for Tron’s TRX (TRX) and dogecoin (DOGE) were 10% and 8.4%, respectively, while rates for market leaders bitcoin and ether were marginally positive.

In other words, the XRP market demonstrated the strongest demand for leveraged bullish exposure among other major cryptocurrencies, including BTC and ether (ETH). That’s consistent with the spike in bullish sentiment for XRP last week, despite the settlement between Ripple and the SEC stalling, as noted by Santiment.

Privacy-focused monero (XMR) stood among tokens beyond the top 10 list with a funding rate of over 23%, while Stellar’s XLM token signaled a strong bias for bearish bets with a funding rate of 24%.

Seasonally weak quarter

Historically, the third quarter has been a weak period for bitcoin, with data indicating an average gain of 5.57% since 2013, according to Coinglass. That’s a far cry compared to the fourth quarter’s 85% average gain.

BTC’s spot price remained flat at around $107,000 at press time, offering no clear direction bias. Valuations have been stuck largely between $100,000 and $110,000 for nearly 50 days, with selling by long-term holder wallets counteracting persistent inflows into the U.S.-listed spot exchange-traded funds (ETFs).

Some analysts, however, expect a significant move to occur soon, with all eyes on Fed Chairman Jerome Powell’s speech on Tuesday and the release of nonfarm payrolls on Friday.